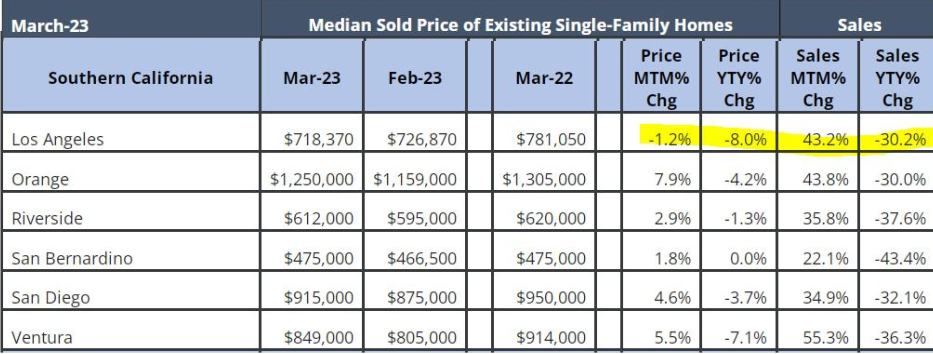

CA Association of Realtors has released the March 2023 Housing Market Statistics. Keep in mind most of these sales went into contract in February with a 30 day escrow.

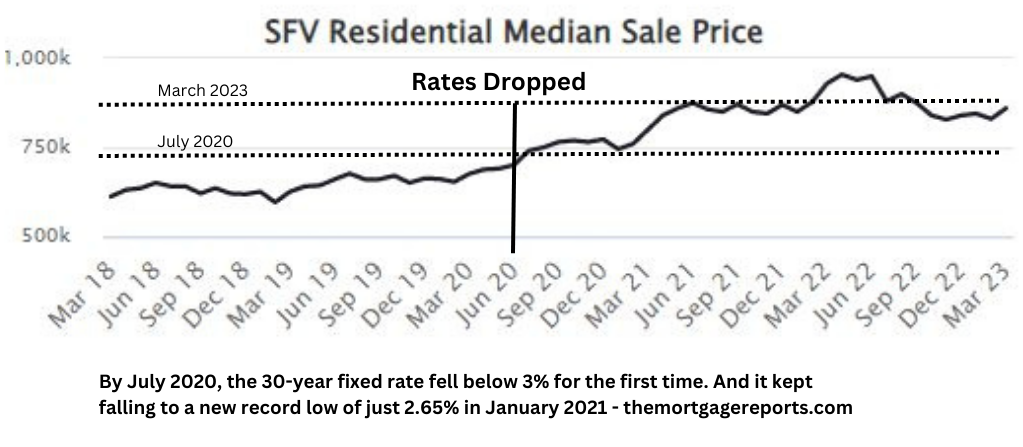

In the Los Angeles County housing market statistics the median price fell slightly in March from February (1.2%) and also is down from same time last year (8%) according to the CA Association of Realtors. While some news media is talking about “plummeting prices” or “plunging prices” it is important to keep in mind where prices are relative to when interest rates were 4% or higher rather than the artificial 3% and lower interest rates. The San Fernando Valley median price is still well above July 2020’s median price (SRAR.com)

Prices peaked in May 2022 during the period of artifically low interest rates. Current prices are clearly impacted by the normalizing of mortgage rates. However I also believe that the fact that many of the properties now being listed are necessary sales, such as Probate and Trust Sales, which often have deferred maintenance and so carry a lower price.

I currently have a fixer probate listing in Northridge (a 1300sq ft house on an 8000 sq ft lot). I expected it to sell for approximately $725,000 but we went into escrow over $750,000 with multiple offers. And the offers came from a mix of owner occupants and investors planning to renovate and add at least one additional unit (ADU).

It is interesting to see that the investors are still very active in the residential market. The investors that are “Buy and Flip” often have a timeline that is at least 6-12 months down the road so their high level of activity in the market is another factor pushing prices higher.

Another stat I watch closely is the months of inventory figure. 6 months inventory is considered a balanced Sellers/Buyers market. The March 2023 sales figures in the San Fernando Valley show 1.8 months of inventory which is recognized as a strong Seller’s market. The drop in inventory from February 2023 stat of 2.7 months of inventory should push prices up in our area.

I still feel strongly that if first time home buyers or Buyers with a lower down payment (such as FHA or VA loans) who want to get into the real estate market should start looking at both properties and loans now. FHA just lowered their Mortgage Insurance Premium as an incentive.

If you want to buy real estate in the 2023 now is the time to learn about what type of loan you can qualify for and want to use for your purchase.

Who to Call

For a free consultation on your home’s value, how to prepare your home to sell or the real estate market in general call me at (818)570-1144 or email [email protected] or visit https://janeybishop.com

SRES, CPE, CPRES, RCSD, CDRE

Senior Real Estate Specialist, Certified Divorce Real Estate Expert Certified Probate Expert

Certified Probate Real Estate Expert, Real Estate Collaborative Specialist – Divorce