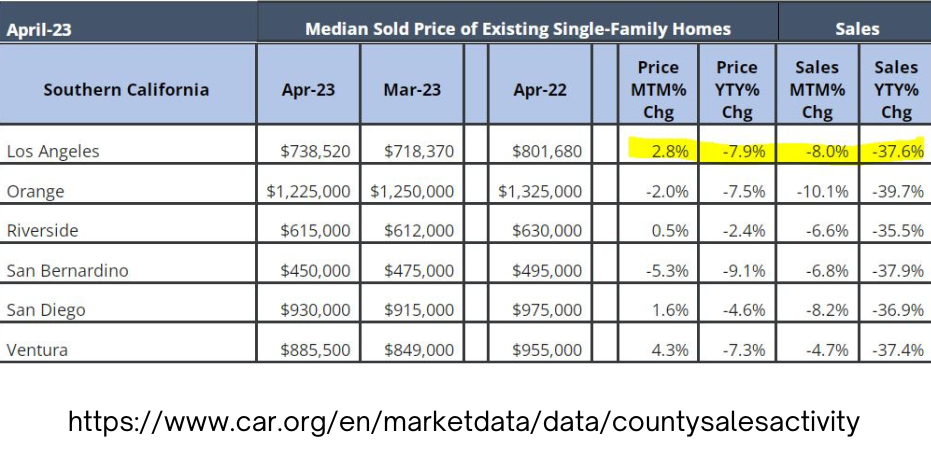

CA Association of Realtors has released the April 2023 Housing Market Statistics. Most of these sales went into contract in March with a 30 day escrow to result in an April closing.

In the Los Angeles County housing market statistics the median price rose in April from March (2.8%) but is still down from same time last year (just under 8%) according to the CA Association of Realtors.

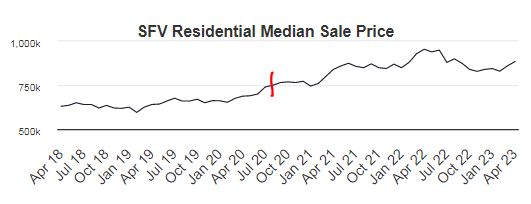

The news media has stopped using the scare headlines about “plummeting prices” or “plunging prices” because the numbers just aren’t supporting it, especially in Southern California. According to a recent Forbes.com article “In a housing market crash, you would typically see a 20% to 30% drop in home prices and a decline in home sales— far more than what’s currently happening. Another crash symptom that’s been missing is a jump in foreclosure activity.” What we are seeing locally is median price deflating back towards where they were pre July 2020 when interest rates dropped below 3% for the first time which overheated the market. And yet prices are still above July 2020.

It is also important to rely more on local figures to make decisions in our market. Right now the key factor is Inventory. In the San Fernando Valley March 2023 inventory sat at 1.9 months supply which is well under the 6 months level for balanced Seller/Buyer market. With this as a factor the median price increased in April. April’s inventory was 2.0 months supply so I am anticipating we will see another modest increase for May median price when the numbers are released in a few weeks.

Due to the interest rate increases “Home buyers and sellers are “staying put,” according to Barbara Corcoran (The Corcoran Group founder and “Shark Tank” star), to keep the lowest rate possible. However, once rates drop, she predicts people will re-enter the residential markets and “buy like crazy. The house prices, I would not put it past the housing market that prices go up by 20%” she stated.

I don’t think rates will drop far enough for that large of an increase to happen but even a 1% reduction with rates holding steady for a longer period of time will bring more Sellers and Buyers out. Consumers don’t like an environment of uncertainty so steady rates will be a key factor.

As a Senior Real Estate Specialist and volunteer I spend a lot of time with Seniors whose company I enjoy. The Seniors I know feel a whole lot better earning interest on their savings accounts again which could raise their comfort level with selling the long time family home and turning it over for the next generation.

Who to Call

For a free consultation on your home’s value, how to prepare your home to sell or the real estate market in general call me at (818)570-1144 or email [email protected] or visit https://janeybishop.com

SRES, CPE, CPRES, RCSD, CDRE

Senior Real Estate Specialist, Certified Divorce Real Estate Expert Certified Probate Expert

Certified Probate Real Estate Expert, Real Estate Collaborative Specialist – Divorce