If you prefer video format here is the YouTube version Click here to view video

CA Association of Realtors has released the December 2023 Housing Market Statistics. Most of these sales went into contract in November with a 30 day escrow to result in a December closing.

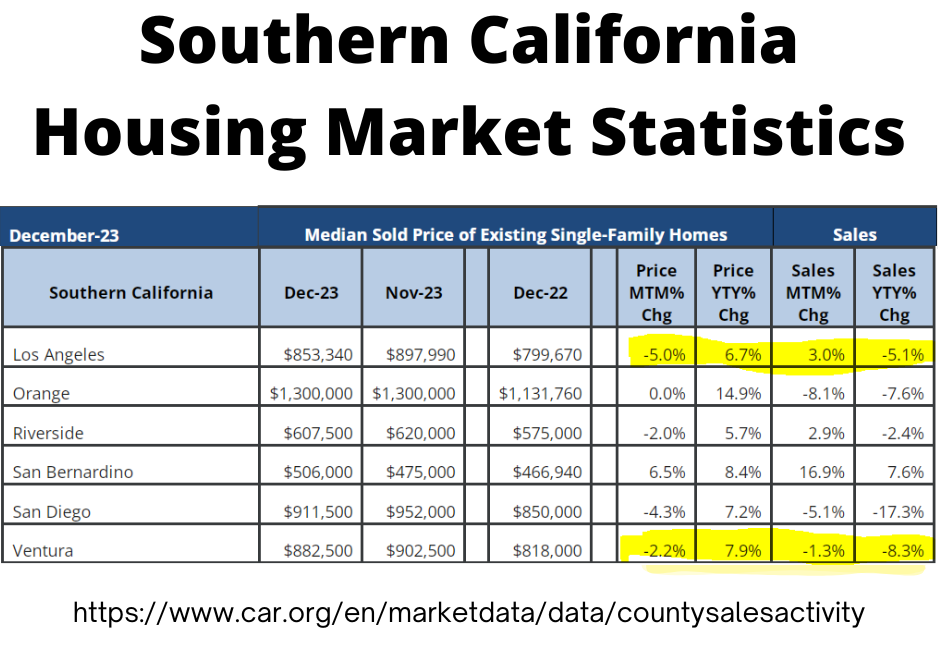

In the Los Angeles County housing market statistics the median price fell sharply in December, 5% in December from November but is up almost 7% from same time last year according to the California Association of Realtors. Ventura County’s prices also fell, a lower 2.2%, and the median price is still almost 8% higher year to year. This would be concerning but the December stats last year showed Los Angeles County median prices fell 4.4% and Ventura County median prices fell 4.9% which support that it is a seasonal trend.

The total sales volume month to month rose slightly 3% in Los Angeles County and fell slightly 1.3% in Ventura County. Both Buyers and Sellers stayed on the sidelines taking a wait and see approach as interest rates were still high.

For November contracts = December sales the 30 year fixed interest rates dropped ranging from 7.76 to 7.22. For December contracts = January sales the rate dropped down an additional 1/2 point but I anticipate we will see a similar seasonal effect.

Rates for week ending Jan 25 were 6.69% which was similar to December. The number of ready, willing and able Buyers has picked up so the key items is the supply of inventory from the Sellers coming off the sidelines. Unfortunately anecdotally a good number of the Seniors I have talked to recently are staying put. In fact one is installing a walkin shower this week to make aging in place easier. There will be a lag of 30-90 days before sales volume picks up allowing for supply to increase and then escrows to close.

According to National Mortgage News on January 24 “Mortgage application activity increased for the third consecutive week, even with rates seeing an uptick, as the purchase market sustained its early-year strength. The Mortgage Bankers Association’s Market Composite Index, a measure of weekly loan application activity based on surveys of the trade group’s members, rose a seasonally adjusted 3.7% for the seven-day period ending Jan. 19. The latest movement comes a week after a larger 10.4% increase. But on a year-over-year basis, volumes came in 14.8% lower. Last week’s data included an adjustment for the Martin Luther King, Jr. holiday. “Mortgage rates increased slightly last week, but there continues to be an upward trend in purchase activity,” said Joel Kan, MBA vice president and deputy chief economist, in a press release. “

What I find frustrating in the news that while the State and City governments are working on increasing the housing supply and “affordable housing” they are hyper focused on rental properties. What we really need is an increased supply of moderately priced properties such as condos and townhouses. Those would allow first time buyers a chance to become owners and offer options for Seniors who are ready to sell their larger empty nest and want a lower maintenance property without having to change neighborhoods.

One other factor I am keeping an eye on is the US commercial real estate market. According to the International Monetary Fund article on Jan 17 “The effects of tightening financial conditions on commercial property prices over the past two years have been compounded by trends catalyzed by the pandemic, such as teleworking and e-commerce, that have led to a drastically lower demand for office and retail buildings and pushed vacancy rates higher. Indeed, prices have slumped in these segments, and delinquency rates on loans backed by these properties have risen in this cycle of monetary policy tightening. These challenges are particularly daunting as high volumes of refinancing are coming due. According to the Mortgage Bankers Association, an estimated $1.2 trillion of commercial real estate debt in the United States is maturing in the next two years.” If local or regional banks fail due to delinquencies on these loans it could impact the general economy.

If you are thinking of buying or selling real estate in the next 6 months it is important to do your homework on what mortgage programs are available and what is the best way to get your home show ready.

Who to Call

General real estate agents are great for working on every day transactions but if you are a Senior who is downsizing, a family settling an Estate in Probate or Trust administration or a family in a Divorce you need a real estate professional trained for these cases.

For a free consultation on your home’s value, how to prepare your home to sell or the real estate market in general call me at (818)570-1144 or email [email protected] or visit https://janeybishop.com

SRES, CPE, CPRES, RCSD, CDRE

Senior Real Estate Specialist

Certified Divorce Real Estate Expert

Certified Probate Expert

Certified Probate Real Estate Expert

Real Estate Collaborative Specialist – Divorce