If you prefer video format here is the YouTube version Click here to view video

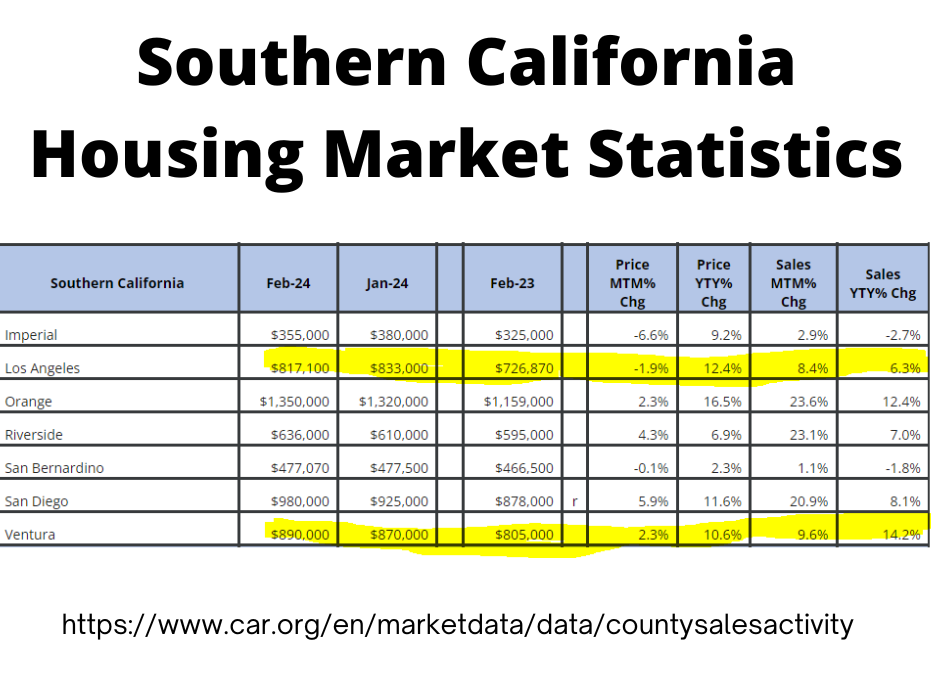

The CA Association of Realtors has released the February 2024 Housing Market Statistics. Most of these sales went into contract in January with a 30 day escrow to result in a February closing.

In the Los Angeles County housing market statistics the median price fell almost 2% in February which is much better than the decrease in February 2023, and increased 2.3% in Ventura County which is about 3% higher than last year same time. Both counties remain up over 10% in median price from same time last year according to the California Association of Realtors.

The total sales volume month to month rose 8.4% in Los Angeles County and almost 10% in Ventura County.

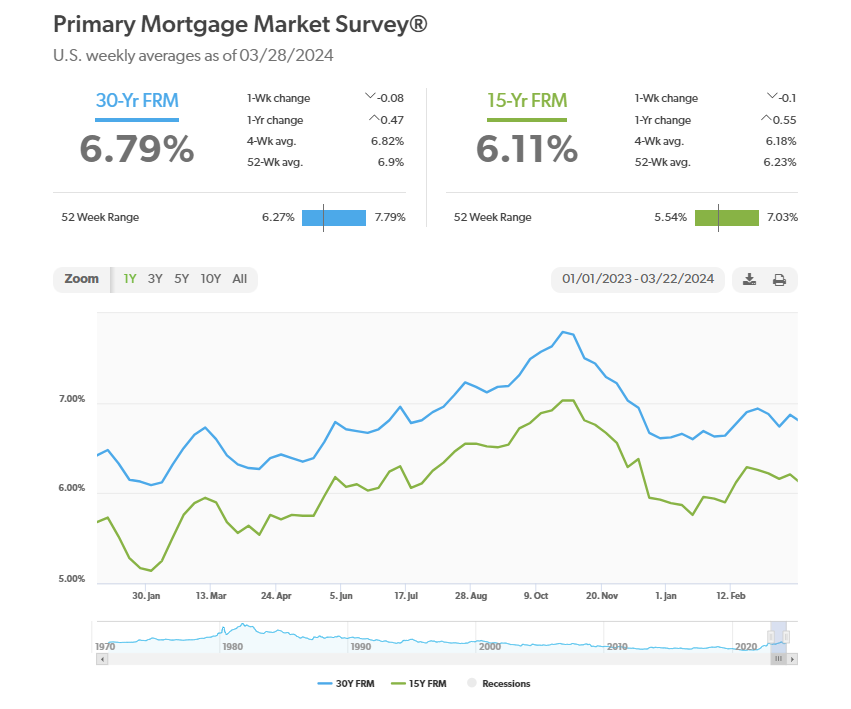

For January contracts = February sales the 30 year fixed interest rates the rates remained right around 6.62 for the month. It was mid February when the rates crept up close to 7%.

The number of mortgage applications ticked up in January which makes sense as potential Buyers returned from the holidays and rates fell. Unfortunately as rates increased in February from 6.62% to 6.9% both Buyers and Sellers went back to the sidelines and mortgage applications dropped again.

More local to the real estate market in Los Angeles, in the San Fernando Valley in January the inventory crept up to 2.9 months of inventory which is similar to what we saw in the Fall of 2023 before the holidays. A balanced market Sellers/Buyers is considered 6 months so we are still in a Seller’s market. Unfortunately in February as the interest rates ticked up the ineventory dropped to 2.7 months. The change in mortgage rates is really fairly small when viewed from a historical basis but I think the news headlines often sensationalize more than is accurate and unfortunately that impacts consumer’s decisions.

A Deeper Understanding of Mortgage Rates

According to Jeff Ostrowsksi of Bankrate “fixed-rate mortgages are tied to the 10-year Treasury yield. When that goes up or down, fixed-rate mortgage rates follow suit. The fixed mortgage rate isn’t exactly the same as the 10-year yield, however; there’s a gap between the two. Typically, the gap between the 10-year Treasury yield and the 30-year fixed mortgage rate spans 1.5 to 2 percentage points. For much of 2023, that margin grew to 3 percentage points, making mortgages more expensive.”

According to MortgageResearch.com “There are at least two factors contributing to large spreads between 10-year Treasury and mortgage rates, according to The Brookings Institution, an independent research organization.

- Prepayment risk: Investors are concerned homeowners will refinance out of their high-rate mortgages the minute rates drop, removing future interest income.

- Low demand: There’s less demand for mortgage-related assets on the secondary market

What factors could impact the gap: With low rates, investors would not be as concerned that homeowners would refinance, leaving them with no financial return. That could attract more investors, increase demand, and bring down rates further. But what about the initial rate drop to get things started? Some things that could do it are lower inflation readings, signs that the economy will cool, or an all-out recession. While some options aren’t ideal, we could see dramatically lower rates in short order if they happen.”

In our area, the real estate market has not really warmed up yet for the Spring and Summer selling season. Buyers are coming off the sidelines but the Sellers are making a slow start keeping inventory relatively low. But there is often a “tipping point” and once potential Sellers start to see more activity they should start to step up. As you know I also feel the shift to Daylight Savings, the longer days and hopefully end to the rainy season should warm things up.

I am also continuing to keep an eye on macroeconomic conditions. The real estate pundits are highly focused on supply and demand which is important but may be overlooking the macroeconomic conditions currently at play – the commercial real estate market, China’s economy and California’s economy.

Who to Call

General real estate agents are great for working on every day transactions but if you are a Senior who is downsizing, a family settling an Estate in Probate or Trust administration or a family in a Divorce you need a real estate professional trained for these cases.

For a free consultation on your home’s value, how to prepare your home to sell or the real estate market in general call me at (818)570-1144 or email [email protected] or visit https://janeybishop.com

SRES, CPE, CPRES, RCSD, CDRE

Senior Real Estate Specialist

Certified Divorce Real Estate Expert

Certified Probate Expert

Certified Probate Real Estate Expert

Real Estate Collaborative Specialist – Divorce